Lasercraft, a world-class precision sheetmetal and plate engineering company, is based in Gauteng and was established in 2004. Occupying 8,600 m2 and with a capacity to employ a workforce of 250 people, the Lasercraft facility is regarded as one of the most modern process-oriented operations in South Africa and probably the Southern Hemisphere.

This majority black-owned facility has earned a reputation of offering competitively priced, high quality products enhanced by efficient and reliable service. With such a solid reputation, Lasercraft has acted as a supplier to several major projects, including the Gautrain and stadiums for the Soccer World Cup in 2010. It has widened its client base and services to include a wide range of industries nationwide including those in the motion industry, electrical distribution, shopfitting, automotive, defence, material handling, general engineering sectors and more.

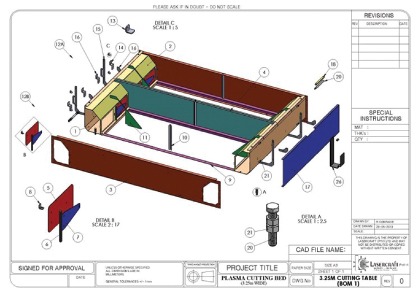

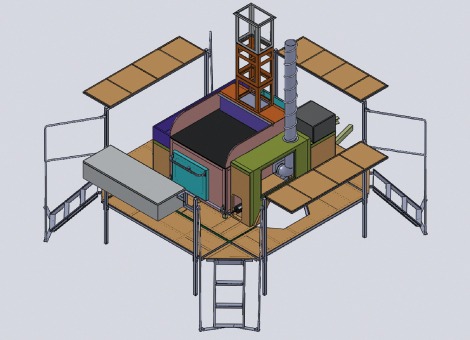

Lasercraft uses Solidworks and various other CAD packages to perform all our design work.

Finished products can be done, from concept to completed product, quickly and efficiently using these design tools.

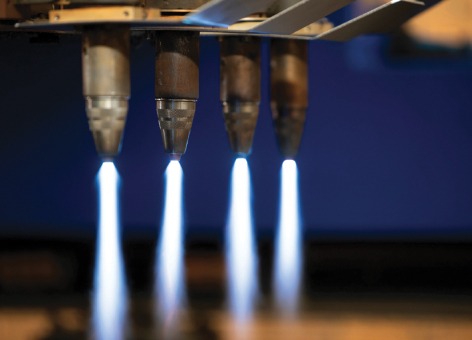

Laser cutting provides a precise method of cutting steel, involving a focused beam of laser light that melts, burns or vaporises metals, thus achieving accurate cuts with a quality finish. Lasercraft owns a number of state-of-the-art laser cutting machines to cater for bulk and custom designs.

Our quality laser cutting machines deliver:

Depending on your specific requirements, Lasercraft can coordinate your complex laser cutting needs.

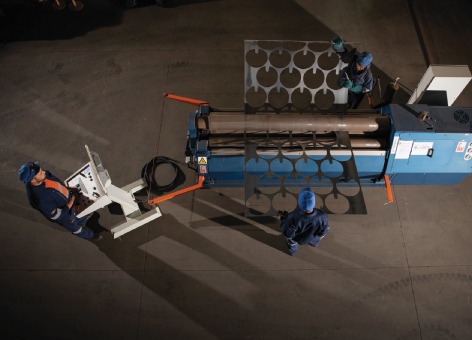

DesignCutWeldmachine & fabricateBendRollASSEMBLY

At the age of 20, Masimo received a tuition waiver (scholarship) to attend Kean University in New Jersey, USA. Following his graduation in 1995, he embarked on his career as a financial data analyst on Wall Street, working for a subsidiary of the Thompson Financial Group. In 1997, Masimo pursued further education, enrolling in an MBA (Finance) program at Rutgers University. Subsequently, he joined Merrill Lynch in London, specializing in convertible bonds trading.

In 2000, Masimo returned to South Africa to oversee an equity derivatives book at Gensec Bank, now known as Sanlam Capital Markets. In 2004, he co-founded Mergence Africa Holdings with a vision to establish a world-class diversified investment group. With R42 billion in assets under management, the group encompasses various sectors including asset management, derivatives trading, property, and industrial holdings.

Masimo serves as Managing Director of the Mergence Group and Non-Executive Chairman of Mergence Investment Managers and Chairman of Mergence Industrial Holdings, and Lasercraft. His expertise in local supplier development and commitment to fostering local content enriches the manufacturing discourse in South Africa. Masimo is inherently entrepreneurial, driven by the belief in “creating shared value” to make a positive impact on the communities in which his business operates.

Bongani joined Mergence Investment Managers in January 2009 to lead business development efforts. With 25 years of experience in the financial services industry, Bongani has meticulously nurtured a vast network, establishing himself as a trusted figure within the industry. His professional journey includes notable positions such as an Institutional Sales Executive specialising in employee benefits, as well as managerial roles in corporate social investment and transformation efforts. Within the Mergence Group, Bongani holds the position on the executive committee, contributing his expertise to strategic decision-making processes.

In recognition of his exceptional leadership and profound understanding of the industrial landscape, Bongani was appointed as an Executive Director of Mergence Industrial Holdings and Lasercraft in 2019. In this capacity, he harnesses his wealth of industry knowledge and extensive network of business connections to drive growth and innovation within the company. Bongani’s involvement underscores Mergence’s commitment to leveraging diverse perspectives and extensive networks to achieve sustainable success in the industrial manufacturing sector.

Andy is a seasoned professional with an impressive 29-year career in the financial services industry. Joining Mergence as Chief Operating Officer (COO) in 2012, he brought with him a wealth of experience and expertise.

Andy’s journey began in the administration of offshore hedge funds in the Caribbean before returning to South Africa in 1995 to embark on a remarkable trajectory in finance. Joining Coronation Fund Managers in early 1996, he honed his skills and climbed the ranks. In 1998, Andy played a pivotal role as one of the founders of FinSource (now Maitland), with Coronation as the lead client.

Driven by entrepreneurial endeavors, Andy took a hiatus from the industry for four years, exploring various ventures. However, his passion for financial services eventually led him back in 2010, initially as a consultant before assuming the role of COO at Mergence in 2012.

Throughout his career, Andy has demonstrated exceptional proficiency in managing operational and administrative divisions within leading asset management and administration companies.

His comprehensive technical knowledge and hands-on experience have been instrumental in his success. Andy currently sits on the Mergence Group and Mergence Industrials executive committee, where he continues to play a pivotal role in shaping the organization’s strategic direction and operational excellence.